Gold surges above $5,060 as soft GDP, hot PCE hit US Dollar

- Gold climbs as weaker GDP and hotter core PCE cloud the Federal Reserve outlook.

- US Dollar slips after the Supreme Court of the United States limits tariffs backed by Donald Trump.

- Markets continue to price two Fed cuts this year despite rising Treasury yields.

Gold prices rally more than 1% on Friday after economic growth in the US decelerated, while inflation rose past the 3% threshold as depicted by the Core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s (Fed) favorite inflation gauge. XAU/USD trades at $5,065 after bouncing off daily lows of $4,981.

Bullion jumps as US growth slows and core PCE tops 3%, stagflation looming?

Breaking news revealed that the US Supreme Court ruled against Trump’s tariffs, imposed under a law intended for national emergencies. This improved risk appetite, as US equities pared earlier losses and turned positive in the day. In the meantime, the US Dollar is on the backfoot, down 0.11% according to the US Dollar Index (DXY).

The DXY, which measures the performance of the American currency against six peers, hovers at around 97.70.

In the meantime, US President Donald Trump said that the Supreme Court decision is disappointing. Nevertheless, he announced that all national security tariffs under sections 232 and 301 remain in place. In the meantime, he added that he will impose 10% global tariffs on top of other duties, under section 122.

Aside from this, economic data in the US showed that the economy is decelerating, according to Gross Domestic Product (GDP) figures for Q4 of last year, while the Core Personal Consumption Expenditures (PCE) Price Index in December increased in the advanced estimates for Q4 of 2025, easing from 4.4% to 1.4% YoY.

GDP decreased from 4.4% to 1.4% YoY, blamed on the 43-day US government shutdown.

Later, the University of Michigan Consumer Sentiment survey dipped from 57.3 to 56.6 as American households mentioned that “higher prices are eroding their personal finances.” Nevertheless, inflation expectations for one-year dipped from 4% to 3.4%, while for a five-year period remained steady at 3.3%.

In the meantime, US Treasury yields erased their earlier losses and are rising, a headwind for the yellow metal. The US 10-year Treasury note yield is up one basis point at 4.081%.

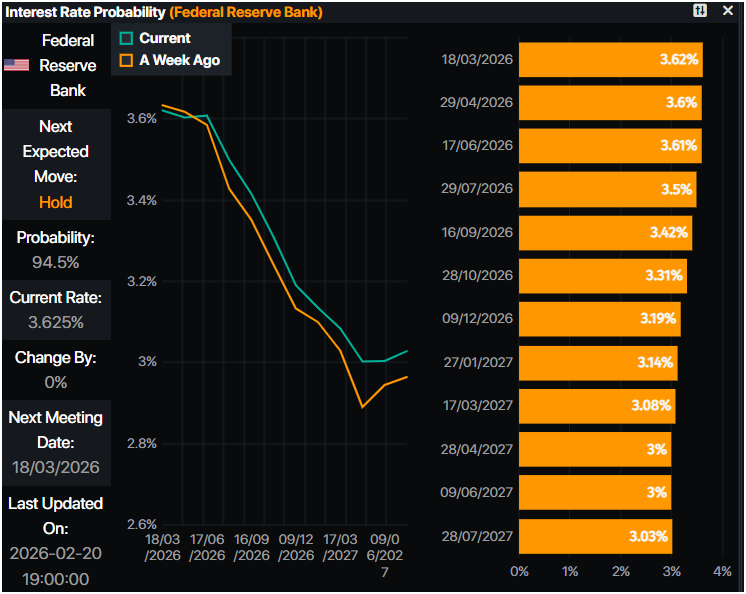

As of writing, money markets had grown skeptical about a rate cut before June 2026, in which Trump’s nominee Kevin Warsh, if confirmed by the US Congress to become the new Fed Chair, could opt to reduce interest rates.

In the Middle East, the US is weighing whether to target Iranian individuals or pursue regime change, according to the Wall Street Journal. Nevertheless, the reports said that he is considering a limited strike on Iran, though he favors diplomacy.

Money markets are still expecting two 25 basis points rate cuts by the Federal Reserve this year, according to Prime Market Terminal data.

US economic schedule for next week

On the data front, traders will eye the ADP Employment Change 4-week average, Initial Jobless Claims data and the Producer Price Index (PPI) report for January. Aside from this, investors will eye speeches by Federal Reserve officials and unscheduled press conferences by US President Donald Trump.

Technical outlook: Gold buyers reclaim $5,000 eyes on $5,100 for further gains

The technical picture shifted neutral to bullish biased, but buyers need to clear the $5,100 milestone to have the chance of driving the yellow metal to retest higher prices. If cleared, the next resistance area will be $5,200, followed by the $5,451 January 30 high. Overhead lies the record high near $5,598.

Conversely, if Gold stays around $5,000-$5,050, it could remain range-bound as traders wait for further catalysts. However, a dip beneath the bottom of the range would expose the February 17 daily low at $4,841, followed by the 50-day Simple Moving Average (SMA) at $4,681.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.