AUD/JPY Price Analysis: Forms a doji around 4-month high, ahead of RBA’s decision

- AUD/JPY experiences a risk-off impulse amid decelerating US business activity and RBA’s monetary policy.

- Despite a lingering upward bias, market sentiment may shift due to the pair’s sensitivity to risk changes, potentially leading to violent swings.

- A balance of technical indicators suggests that AUD/JPY could target a lower range, with resistance remaining at the four-month and year-to-date highs.

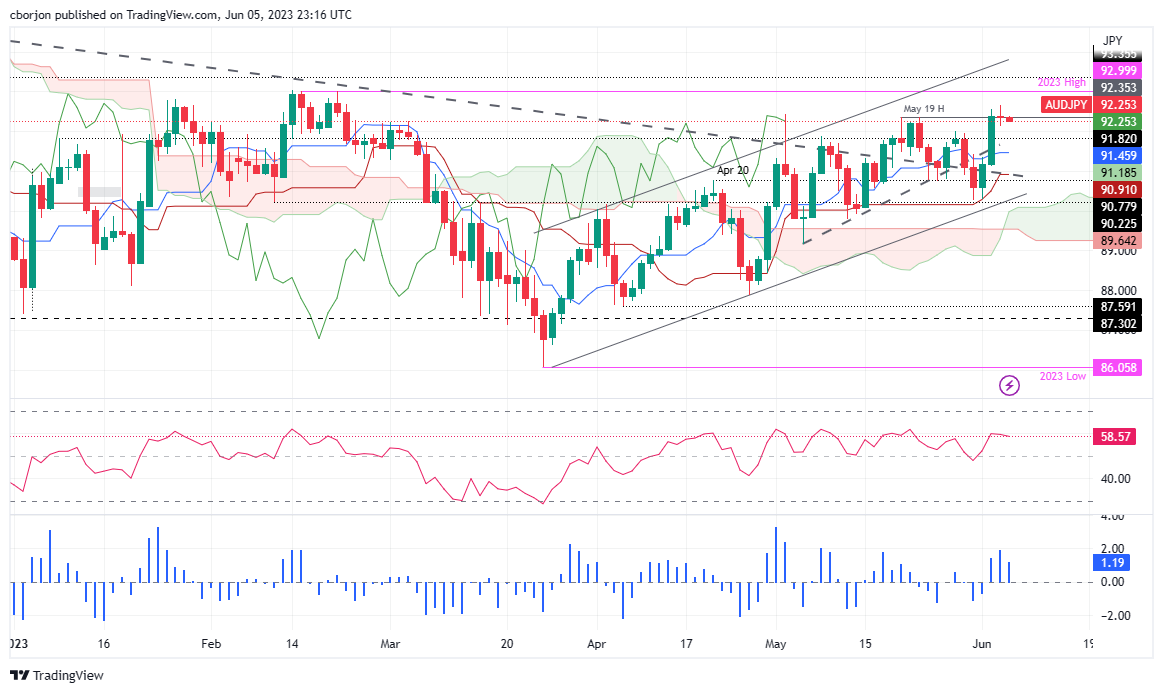

AUD/JPY forms a doji, as shown by the daily chart, after hitting a fresh four-month high at 92.66, hovering nearby the 92.30s area, after trading within the 9213/66 range on Monday. A risk-off impulse was the main reason behind price action, with US business activity decelerating, while expectations for the Reserve Bank of Australia (RBA) to keep unchanged its interest rates at the upcoming monetary policy on Tuesday pressures the Aussie (AUD).

AUD/JPY Price Analysis: Technical outlook

From a daily chart perspective, the AUD/JPY is still upward biased, but given the nature of being used as a currency pair that reflects market sentiment, a risk-off impulse could shift the bias of the AUD/JPY. As long as the AUD/JPY remains above the Ichimoku cloud, the pair is upwards, but the Chikou Span, piercing May 2 candlestick chart at around 92.25, could trigger a sell signal, which could lower the price.

The Relative Strength Index (RSI) indicator is still bullish, but the three days Rate of Change (RoC) portrays that buying pressure is easing. Therefore, the AUD/JPY could aim toward the Tenkan-Sen Line at 91.46, as an initial target, in the near term, followed by the confluence of a support trendline and the Kijun Sen at 90.91.

Conversely, the AUD/JPY first resistance would be the four-month high at 92.66 before testing the YTD high at 92.99. A breach of the latter will expose the last year’s YTD high of 98.59.

AUD/JPY Price Action – Daily chart